Professional Financial Accoutants & Business Consultants

We pride ourselves on the way we serve our clients. As Chartered Accountants, we work outside the box to come to a solution that is highly desirable and tax-effective for all our clients.

Make an Appointment

About Us

Helping Your Business

Succeed

Brisbane Business and Taxation Services is a firm of Chartered Accountants and Business Consultants focused on adding value to your business and working with you to achieve a significantly favourable outcome.

At Brisbane Business and Taxation Services, we value our clients as long-term partners. The better we understand your business, the more easily we can identify ways to help you succeed.

ABN: 67 652 615 079

- Professional Taxation Services

- Expert Business Consultants

- Skilled Property & Investment Advisors

Contact Us

What do We offer

Online Services

Accounting

At BBTS we focus on using financial reporting as a management tool to help our clients grow and develop their businesses.

Read more

Taxation & GST

We are a professional and reliable firm of tax specialists, tax advisers and payroll specialists.

Read more

Property Programs

Programs specifically tailored to help you buy new & established property & become cashflow positive within a short timeframe.

Read more

Learn More About Our Property Programs

Supporting You & Your Business At Tax Time

Services

Our Tax Time Products

From July through to September we offer the following tax return promotions:

- Single Individual PAYE Tax Return – Starts from $77 inc GST

- Single Individual PAYE Tax Return Including 2 residential investment properties – $120 inc GST

- Couple PAYE Tax Return Including 2 residential investment properties – $220 inc GST

Our Team

Sumanjeet Kaur

Director

Sumanjeet Kaur is a director and enjoys the challenge of accounting and taxation and looking after business and tax clients. Her experience in public accounting provides her with a deep understanding of the compliance and taxation needs of clients.

Sumanjeet has a clear understanding of an integral part that astute advice, based on knowledge and experience, plays in the decisions made by Business Owners and Investors. An Accountant is given a position of trust and Sumanjeet is conscious that his trust cannot be taken for granted and endeavours to provide accurate, professional, timely, and prompt advice.

Bahadur Singh C.A.

Senior Accountant

Bahadur Singh, a Chartered Accountant, has worked in Public Practice for over 10 years. Bahadur values the connection that he has made with his clients and appreciates the opportunity they give him to assist and work with them for a better outcome.

He has worked in Taxation and compliance in various industry sectors including small to medium scale businesses, large companies, franchisees and franchisors covering wide areas of Income Tax, Payroll Tax, Goods & Services Tax, and Fringe Benefits Tax, and including Personal Taxation and Negative Gearing.

Komal Preet Singh

Accountant

Komal has completed his Bachelor of Commerce and currently undertaking the CPA Program, designated as ASA.

He commenced employment with BBTS as an Accountant in January 2022 and inspired by Bahadur Singh’s assistance and continuous monitoring has learned more than he had expected when it comes to serving the needs of our clients.

Komal’s dedication and hard work with client affairs and continuous training provided by Bahadur have made him the Accountant that one desires, and he has a long way to go.

Laurence

The Money Man

…

…

…

…

Our Programs

Property Starter Program

Perfect for first home owners, returning homeowners, or 1st investment property purchasers

- 2-18 month program

- For first home owners, returning homeowners, or 1 st investment property purchasers

- Credit Repair assistance including credit report check to confirm credit status

- Borrowing capacity check

- Accountant prepared property costings analysis to confirm costs of property purchase and deposit required

- 2 individual tax returns for the most recent tax year that has not been completed – include investment property deductions and tax variations as required

- Buy new or established properties

- Access to property stock through our network of real estate agent partners.

- Property cashflow analysis to demonstrate the cash flow requirements of the property and its affordability for your individual situation

Contact Us To Learn More

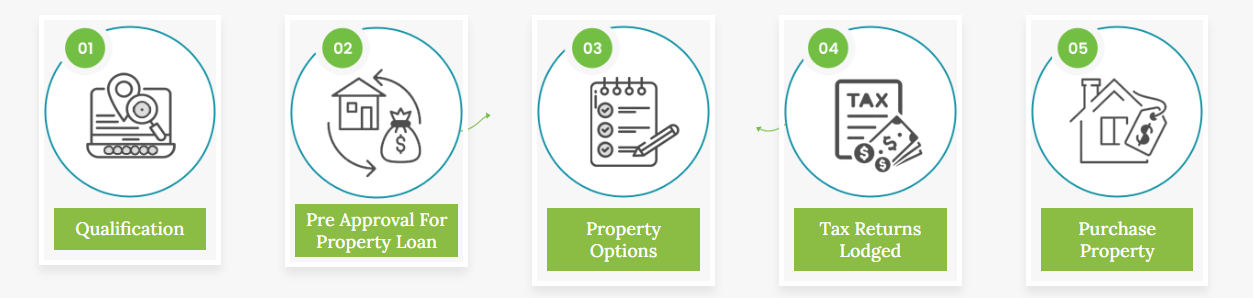

Process

Property Starter Program

Download Full PDF Of Process

Our Programs

Tax and Debt Reduction Through Property Program

Perfect for first home owners, returning homeowners, or 1st investment property purchasers

- 24-36 month program

- Everything included in the Property Starter Program

- New or Established Property

- Residential, Commercial, or Developments

- Borrowing Capacity Review every 6 months

- 2 tax planning meetings including a review of all the tax deductions available for your situation and how they can be applied

- 2 individual review meetings

- 4 individual tax returns including investment property deductions, tax variations, and capital gain/losses schedule

- Property Strategies to be discussed and implemented as appropriate including the long-term holding of investment properties, short-term buy and sell options, and commercial and development projects with the view to maximize tax deductions and reduce debt Project management assistance to help with cash flow management, development, and sale of a project as required

- Full property and/or project costings covering costs, equity requirements, funding requirements, and income requirements

- Access to property stock and projects through our network of real estate agent partners

- Access to our broker and private funder associates to secure the funding required for property or project undertakings

- Budget and cash flow management of personal, investment, and project properties for 24 months starting from the date of purchase or acquisition.

- Tax savings goal of 50% of tax paid within 36 months.

Contact Us To Learn More

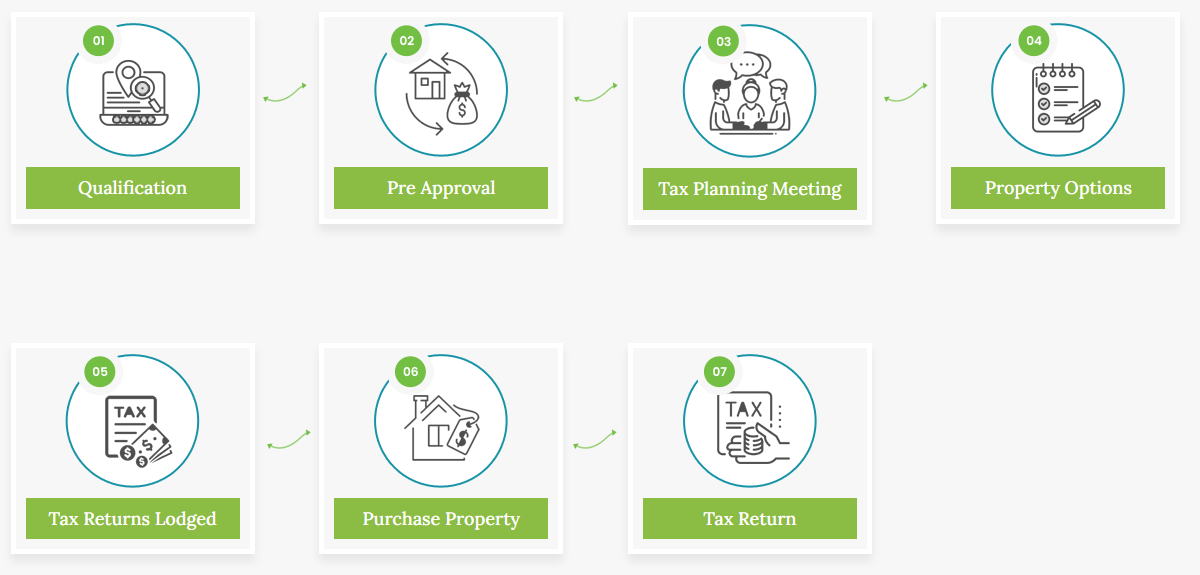

Process

Tax and Debt Reduction Through Property Program Process

Download Full PDF Of Process

Plans For Every Need

Pricing & Packages

Bronze

$

150

Monthly

-

Quartey BAS/IAS Preparation and Lodgement -

No Payroll -

Quarterly Reports -

Annual Business tax return -

Annual Financial Statements

Silver

$

220

Monthly

-

Quartey BAS/IAS Preparation and Lodgement -

Single Touch payroll processing up to 2 employees -

Review Wage & PAYG reconciliation -

Quarterly reports -

Annual Business tax return -

Annual Financial Statements

Gold

$

285

Monthly

-

Quartey or Monthly BAS/IAS Preparation and Lodgement -

Single Touch payroll processing up to 5 employees -

Review Wage/PAYG/Superannuation reconciliation -

Monthly reports -

Annual Business tax return -

Annual Financial Statements -

Up to 2 associated individual tax return

Get A Quote

Popular

Platinum

$

485

Monthly

-

Bank Reconciliation -

Accounts payable/Accounts receivable -

Quartey or Monthly BAS/IAS Preparation and Lodgement -

Review Wage/PAYG/Superannuation reconciliation -

Monthly reports -

Preparation and Lodgement of Income Tax returns/Financials -

Consulting for possible grants etc. -

Up to 2 associated individual tax returns -

Tax planning

Get A Quote

Plans For Every Need

Other Fees & Add-ons

-

Standard individual tax return (Wages only) – $90 -

Standard individual return with one investment property (plus $30 for every extra property) – $180 -

A standard individual with one CGT event ($50 for every extra CGT event) – $170 -

Tax Return-Sole Trader – $220 -

Tax Return-Family Trust, Company, Partnership -without Financials- $750 -

Tax Return-Family Trust, Company, Partnership -with Financials- $1100 -

Company Registration Including ASIC Fee- $770 -

ABN GST PAYG Registration- $220 -

Trust setup- $555 -

Tax Planning report Only- $660

Contact Us

Get in touch!

Would you like to speak to one of our team members over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

For Businesses: Do you have questions about how can we help your company? Send us an email and we’ll get in touch shortly, or phone 1300246941 between 09:00 am and 05:00 pm Monday to Saturday — we would be delighted to speak.

Note: Your details are kept strictly confidential as per our Privacy Policy.

Office 10 Building 618 Torbey StreetSunnybank Hills QLD 4109

1300 246 941

[email protected]